Some Known Details About Financial Advisor License

Wiki Article

Unknown Facts About Advisor Financial Services

Table of ContentsThe Greatest Guide To Financial Advisor RatingsNot known Details About Financial Advisor Salary 6 Simple Techniques For Financial Advisor MagazineAdvisor Financial Services Things To Know Before You Get This

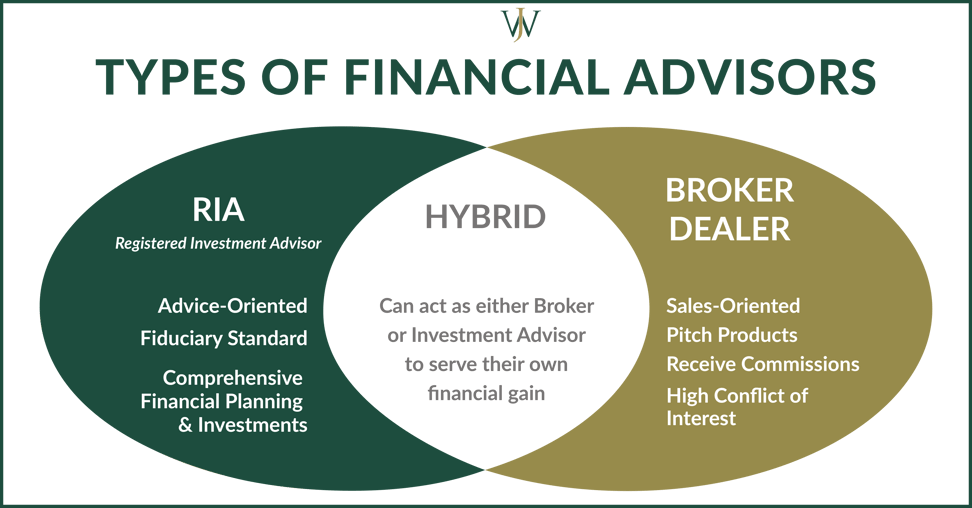

There are a number of types of financial consultants available, each with varying credentials, specializeds, as well as levels of responsibility. And when you get on the search for a specialist suited to your requirements, it's not unusual to ask, "How do I know which financial advisor is best for me?" The solution starts with a truthful accounting of your demands and also a little of research.That's why it's important to study prospective experts and recognize their certifications before you turn over your money. Sorts Of Financial Advisors to Think About Relying on your economic needs, you may decide for a generalised or specialized economic advisor. Knowing your alternatives is the primary step. As you begin to study the globe of looking for a monetary advisor that fits your needs, you will likely exist with many titles leaving you asking yourself if you are getting in touch with the ideal person.

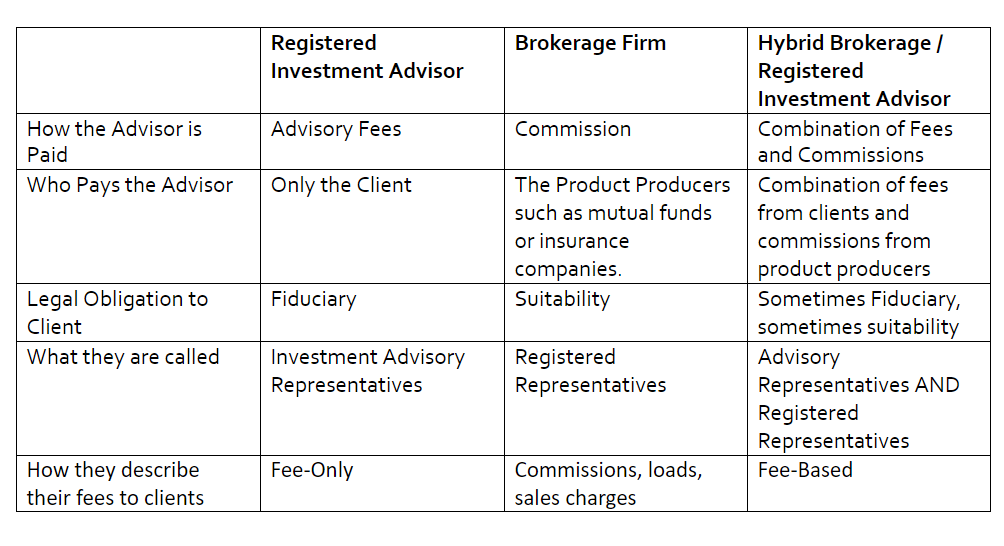

It is crucial to note that some economic advisors likewise have broker licenses (meaning they can offer securities), yet they are not solely brokers. On the very same note, brokers are not all certified equally and are not financial advisors. This is just among the lots of factors it is best to start with a certified economic coordinator who can encourage you on your investments and retired life.

5 Simple Techniques For Financial Advisor Magazine

Unlike financial investment experts, brokers are not paid directly by clients, instead, they earn compensations for trading supplies and also bonds, as well as for marketing mutual funds and also other products.

A recognized estate coordinator (AEP) is an expert who specializes in estate planning. When you're looking for a monetary expert, it's nice to have a suggestion what you want assistance with.

Similar to "monetary expert," "financial coordinator" is likewise a wide additional resources term. A person with that said title can also have other qualifications or specializeds. Despite your particular needs and financial scenario, one requirements you need to highly think about is whether a possible consultant is a fiduciary. It might shock you to discover that not all financial experts are called for to act in their customers' benefits.

Some Known Incorrect Statements About Financial Advisor Certifications

To protect yourself from someone who is just trying to get even more money from you, it's an excellent suggestion to search for a consultant who is signed up as a fiduciary. A monetary advisor who is registered as a fiduciary is required, by legislation, to act in the very best interests of a client.Fiduciaries can just advise you to utilize such products if they believe it's actually the very best economic choice for you to do so. The U.S. Securities and also Exchange Payment (SEC) regulates fiduciaries. Fiduciaries that stop working to act in a client's benefits could be hit with fines and/or jail time of as much as ten years.

That isn't due to the fact that any individual can obtain them. Obtaining either accreditation needs somebody to go with a selection of courses and tests, in addition to gaining a collection amount of hands-on experience. The outcome of the certification process is that CFPs as well as Ch, FCs are fluent in subjects throughout the area of personal money.

For example, the cost could be 1. 5% for AUM in between $0 as well as $1 million, yet 1% for all assets over $1 million. Charges normally lower as AUM increases. A consultant that generates income only from this monitoring click for more info charge is a fee-only expert. The option is a fee-based expert. They sound comparable, but there's an important distinction.

Examine This Report about Advisors Financial Asheboro Nc

For instance, an advisor's administration fee might or may not cover the expenses connected with trading safety and securities. Some advisors additionally charge an established cost per transaction. Make certain you recognize any kind of and also all of the costs an expert charges. You don't wish to place every one of your money under their control only to deal with surprise shocks later on.

This is a service where the expert will bundle all account administration costs, consisting of trading costs as well as expense proportions, right into one thorough fee. Due to the fact that this cost covers more, it is normally higher than a charge that only consists of administration and also excludes things like trading prices. Cover costs are appealing for their simpleness however also aren't worth the price for everyone.

They likewise charge costs that are well below financial advisor business the advisor costs from standard, human consultants. While a standard expert normally bills a fee in between 1% as well as 2% of AUM, the fee for a robo-advisor is generally 0. 5% or less. The huge compromise with a robo-advisor is that you commonly do not have the ability to chat with a human consultant.

Report this wiki page